Reinsurance is hard. We make it easy.

Powerful insights, simplified operations, & better collaboration with our reinsurtech platform for:

See how your legacy tech stacks up.

We’ve seen the reinsurance industry waste what amounts to years on tedious admin. That stops now. Download this free two-page PDF to see how our reinsurance platform compares against your legacy tech.

Reinsurance deserves more than generic software.

Working with scattered data, clunky systems, and awkward email trails takes time away from value-add work.

Supercede fixes that by facilitating efficient, transparent, and highly connected reinsurance.

Our web-based platform introduces two solutions: Packs and Deals. These tools provide powerful insights into your data, better presentation of risk, and secure, seamless collaboration.

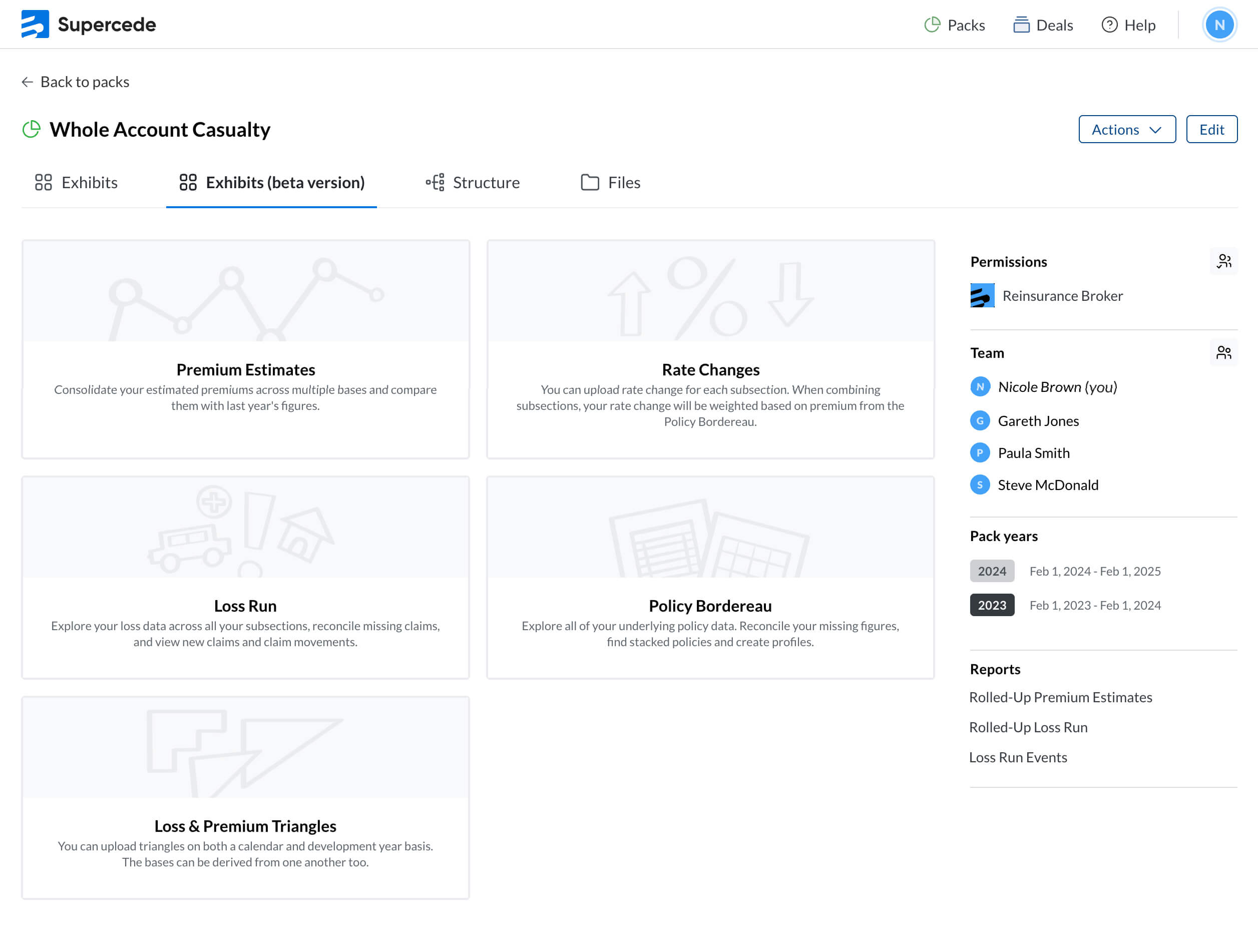

Packs

- Prepare, validate, and cleanse data at significant speed.

- Access deeper portfolio insights from your underlying data.

- Automate the creation of outwards reinsurance submission exhibits, including:

- Premium Estimates

- Rate Changes

- Policy Bordereau

- Loss Run

- Loss & Premium Triangles

- Share submission exhibits selectively with reinsurers.

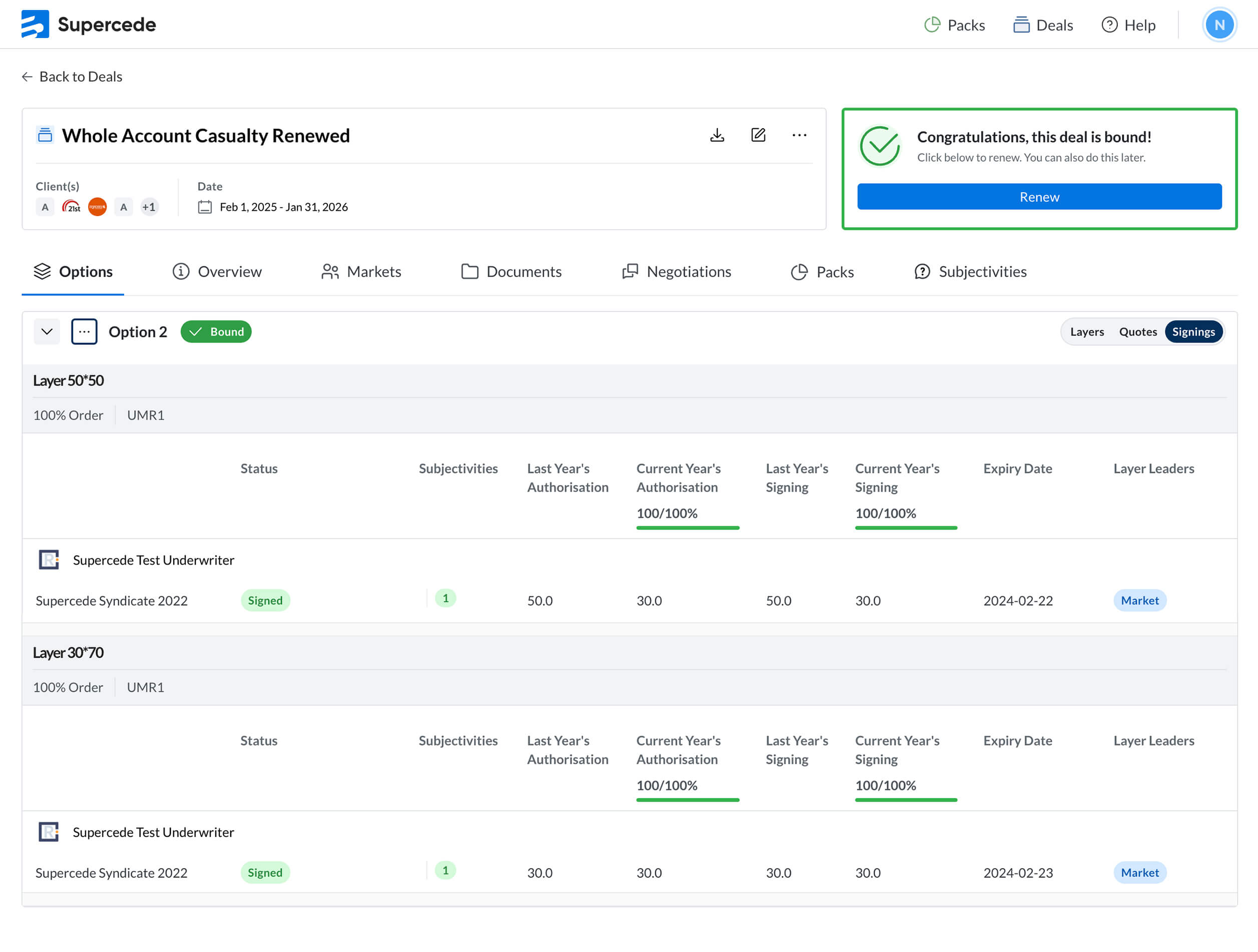

Deals

- Track and manage outward reinsurance in a single workflow.

- Options for real-time collaboration.

- Easy extraction of deal data into core systems.

- Renew existing structures.

- Explore multiple structure options.

- Place firm orders.

- View post-placement deal information.

- Maintain full audit trails and activity logs.

All-In-One for All You Do.

Clean reinsurance data.

Supercede’s reinsurance software will automate the creation and validation of submission pack analytics. Share accurate data directly with brokers to build better deals.

Learn More

Intuitive placements.

Create complex deals with our intuitive workflow, allowing you to share digital risk profiles with underwriters and automate tedious data ingestion into core systems.

Learn More

Better risks.

Seamlessly integrate Supercede into your existing systems, enhancing your workflow without the hassle of managing another standalone tool. Benefit from superior data quality, unlocking deeper insights and greater transparency.

Learn MoreWe felt your frustrations. Then we fixed them.

We know how inefficient it is to constantly switch between emails, spreadsheets, file sharing sites and policy admin systems. Copying, pasting and losing data in “solutions” that were never built for reinsurance.

It’s more than insurance systems can handle.

Reinsurance deals are bespoke, handcrafted masterpieces, and certainly worthy of their own technology. Supercede’s independent reinsurance software was purpose-built by former industry practitioners.

Start TrialThe reinsurance ecosystem built for collaboration.

Supercede was built to handle the complexities of global reinsurance deals; we facilitate accurate data flow from outwards ceded reinsurance teams and brokers for reliable presentation of risk to reinsurers.

Cedent

Broker

Reinsurer

Import

Wizard

Data

Validation

Pack

Creation

Data

Standardisation

Profile

Builder

Pack

Sharing

Deal

Building

Reporting

Data

Management

Data

Validation

API

Integration

Portfolio

Consolidation

Complex Deal

Structuring

Automation

Tools

Renewal

Templating

Deal

Management

Deal

Publisher

Networking

Global

Marketplace

Deal

Negotiation

Signings

Deal

Discovery

Quote

Submission

Risk

Binding

What our clients say

“Supercede is going to allow us to transform the way we prepare our reinsurance submissions, resulting in less time spent on administrative tasks and reconciliation, and more time on analytics and collaborating with our brokers on strategy. The Analytics platform will allow us to prepare our larger submissions in weeks and not months, while also laying the foundation for a more digital placement process with our brokers and reinsurers.”

“We have dedicated tools which provide comprehensive reporting capabilities, however, the integration of Supercede’s reinsurance platform into our internal systems will add multiple efficiencies to our processes, allowing us to capture data more quickly. Over time these efficiencies will not only benefit ourselves, but also our valuable broking partners.”

“Our independence allows us to focus entirely on meeting our clients' needs. By integrating Supercede's automation technology, we can work more efficiently and provide unmatched service quality to our clients."

“We feel this is a well-designed product that can reliably help us with data challenges; importing, compiling, and organising reinsurance data in a meaningful way is difficult even at the best of times. Supercede helps to ensure our data is well-structured and is sent out in a very timely manner.”

“There’s huge value in reducing manual processes when it comes to data cleansing and preparation and validation. It’s nice to have my team able to work on other significant tasks without so much of their time taken up by spreadsheets. Supercede has given us a massive advantage in this regard.”

"This collaboration is an exciting pathway for us to revolutionise our data submission processes. The [Supercede] platform has been incredibly helpful for improving data quality, enabling us to more acutely assess risk through transparency and analytics."

“We are a small but committed reinsurance team, and Supercede has given us a new superpower. To have all of our data in one consistent, easily accessible format is one thing, to be able to do this whilst reducing the time ordinarily taken is an immense added benefit”

Featured In

Take a tour

Still have questions about our reinsurance platform? We’re here to talk.